Gaza conflict poses grave risks for weak global economy; even Nostradamus would be stumped

As with Ukraine, the Gaza conflict will divide the world as countries take sides. This reflects historical allegiances but often erroneous readings of national interest and a desire to maximise domestic electoral advantage. Such events expose deep-seated hypocrisy and double standards, over issues like supply of armaments, war crimes and humanitarian concerns, heightening divisions.

America may find itself weakened. Its unequivocal support for Israel undermines its ability to play a role in the Arab Middle East. Qatar, UAE, Saudi Arabia, Jordan and Egypt, which have sought to defuse tensions in the region, will find it difficult to engage with a United States which at the first provocation immediately and unthinkingly reverts to partisan positions irrespective of wider implications. Middle East rulers also remain wary of the existential threat to their regimes from American encouraged colour revolutions and the ill-fated Arab spring.

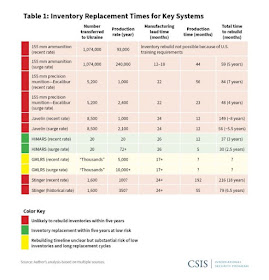

The shift of resources to Israel, potentially abandoning Ukraine, raises questions about the USA's capabilities. Countries reliant on American military protection (Europe, Japan, South Korea, Taiwan, Australia and the Gulf states) as well as competitors (China and Russia) will have taken note.

Unstable leadership, and dysfunctional legislative processes and foreign policy inconsistency undermines US credibility with allies and enemies alike.

These political factors will shape the economics through several channels, primarily the disruption of trade and commerce which requires relative geo-political stability to thrive.

First, trade, already slowing, may weaken further.

Second, inflationary pressures may return. With recent improvements driven mainly by lower energy prices, the Gaza conflict combined with ongoing restrictions on Russia has the potential to drive energy costs higher. In the worst case, a circa-1974 oil embargo or blockades of the Straits of Hormuz and the Suez Canal would change price dynamics dramatically.

hird, public finances may deteriorate. The post-1989 economy reaped the benefits of a 'peace dividend' as defence spending declined from around 5.5 percent of Gross Domestic Product ("GDP") in 1989 to 2.6 percent of GDP in 2000. This will now reverse undermining more productive sectors of the economy. With government revenues stagnant, countries will move further into deficit and debt.

Fourth, the dollar's role as the dominant currency for trade and investment of reserve assets will be affected. Sanctions, exclusion from payment mechanisms and seizure of assets mean a search for alternatives. While the dollar's demise is not imminent, attempts by countries to establish new trading arrangements, denominate trade in their own currency, establish alternative funds transfer systems and rebalance reserves away from the dollar will accelerate. The likely fragmentation of global capital flows will affect debtor countries like the US which need to finance a significant portion of its budget and trade deficit (around 8 percent of GDP combined) externally.

Global bodies like the United Nations or G-pick a number, will lose influence as alternatives such as the BRIC+ compete for hegemony.

Satyajit Das is a former banker and author of numerous works on derivatives and several general titles: Traders, Guns & Money: Knowns and Unknowns in the Dazzling World of Derivatives (2006 and 2010), Extreme Money: The Masters of the Universe and the Cult of Risk (2011), A Banquet of Consequences RELOADED (2021) and Fortune’s Fool: Australia’s Choices (2022). His columns have appeared in the Financial Times, Bloomberg,WSJ Marketwatch, The Guardian, The Independent,Nikkei Asia and other publications.

© 2023 Satyajit Das. All Rights Reserved

No comments:

Post a Comment